Get-rich-quick scams: How to spot and avoid them

Security

Get-rich-quick scams

The idea of making quick, easy money is tempting. And scammers know it. Learn how they work so you can avoid falling into their traps.

What are they?

These scams sometimes involve criminals trying to transfer stolen money through someone else's bank account so the authorities can't track them down. If you move stolen money for someone, you're acting as a money mule.

How scammers work

Young people are common targets of these kinds of scams. Scammers will approach you on social media or in public places. They may ask you to let them use your bank account to make transactions in return for cash. They'll tell you it's a quick, easy way to make money. But because the money was made from illegal activity, participating in the scam is a crime.

What are the risks?

Criminals will tell you that you won't get into trouble for letting them use your account. This is not true. You are responsible for any fraudulent transactions on your account. Even if you didn't know it was a scam, you're an accomplice to fraud.

Being involved in fraud can lead to serious consequences. For example, you may:

Heads up, parents!

If your child is a minor, you may have to pay the money back even if the account used for fraud was opened without your consent.

How to recognize a get-rich-quick or money mule scam

The best way to avoid these kinds of scams is to know how to spot them. Here are some red flags to watch out for.

- Someone you don't know, who might claim to be a friend of a friend, contacts you on social media or in a public place

- You receive a tempting offer to make a lot of money quickly and with no risk

- You're asked to make transfers, withdrawals or other transactions with your account

- You'll need to give your banking information to someone

- You're promised a cut of the money in exchange for using your account

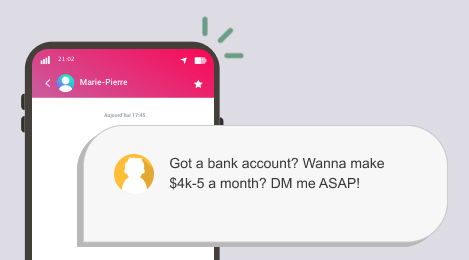

Sample scammer message

Scammers may use social media posts to attract your attention.

3 warning signs for parents

- Your child has new clothes or expensive things and appears to be spending more than usual

- They seem stressed or anxious, or get defensive when you talk about money

- Your child is hanging out with new people and doesn't talk about them

How to report a scam

If you've been persuaded to make transactions on your account or know someone else who has been, report it right away.

Contact us

Call us quickly so our security team can help you take charge of the situation.

Montreal area:

514-397-8649

Elsewhere in Canada and the US:

1-866-335-0338

Other countries:

514-397-4610 (collect call)

Contact the authorities

By telling the authorities, you'll prevent others from falling into a similar trap and help the police dismantle criminal networks.

Sûreté du Québec - External link. This link will open in a new window.

Canadian Anti-Fraud Centre - External link. This link will open in a new window.How to prevent these scams

3 tips to protect yourself

- Never share your personal and confidential information, even with close friends.

- Be careful what you say on social media and keep your accounts private. Scammers sometimes use what you say to trick you.

- Be wary of messages on Instagram, Snapchat, Facebook or other social media offering you the chance to make a lot of money. They're usually scams.

3 ways to make your child more aware

- Talk with your child about the risks and consequences of sharing personal and confidential information

- Warn your child that scammers are active on social media

- Encourage your child to talk to you or another adult they trust when in doubt